How many times have you canceled a transaction that Shopify’s fraud tool flagged as an elevated fraud risk, only to find out it was actually legitimate?

Do customers call asking why their orders are being declined, when Shopify labels those transactions as fraudulent?

If you’re relying on Shopify’s free Fraud Analysis tool to protect your business from fraud, you may be surprised to learn how conservative pass/fail decisions are — and how much money, time, and headache it may be unnecessarily costing you and your customers.

NoFraud collected and analyzed data from over 10 million ecommerce transactions that have gone through both Shopify’s fraud tool and NoFraud’s fraud prevention app and compared the accuracy of the decisions generated. The statistics are staggering:

- 23.1% of all orders classified as “high-risk” by Shopify received a “pass” by NoFraud, with a chargeback guarantee.

- A whopping 80% of all orders that Shopify deemed “medium-risk” were, in fact, safe to ship, backed by our chargeback guarantee.

- In the apparel and accessories industry alone, Shopify’s Fraud Analysis flagged orders with a “cancel” or “investigate” decision — yet 60% of these flagged orders were actually safe to ship.

What Percentage of Shopify “Cancel” and “Investigate” Orders Are Safe to Ship?

Here are the stats broken down by industry for orders that Shopify classified as medium-risk (“investigate”), but were actually safe to ship:

- Animal & pet supplies: 67.5%

- Apparel: 80.4%

- Appliances: 90.5%

- Audio equipment: 20%

- Auto parts: 75.1%

- Cosmetics: 80.7%

- Eyewear: 81.7%

- Footwear: 78.6%

- Furniture: 88.7%

- Nutritional supplements: 86.5%

- Smoke & vape: 64.6%

- Sporting goods: 83.6%

- Toys: 84%

- Wigs & extensions: 81.9%

- Wine and spirits: 95.1%

Here are the stats broken down by industry for orders that Shopify classified as high-risk (“cancel”), but were actually safe to ship:

- Animal & pet supplies: 10.8%

- Apparel: 18.8%

- Appliances: 21.8%

- Appliances: 36%

- Audio equipment: 20%

- Auto parts: 27%

- Cosmetics: 42.6%

- Eyewear: 16.9%

- Footwear: 20%

- Furniture: 39.4%

- Nutritional supplements: 19.3%

- Smoke & vape: 16.4%

- Sporting goods: 36.7%

- Toys: 23.9%

- Wigs & extensions: 30.2%

- Wine and spirits: 27.2%

You may be wondering, “How do these error rates truly affect my business?”

The truth is, as many as 80% of orders are declined that are in fact legitimate. A false decline can cause more harm than just the loss of profit on one order. A Javelin survey revealed that 39% of consumers would not shop with a merchant again if their card was declined. In today’s competitive ecommerce landscape, precise fraud prevention is a must if companies want to retain a loyal customer base and generate repeat business.

And, especially if you’re in an industry that is particularly susceptible to fraud, the sad reality is that Shopify’s free tool may be hurting you almost as much as it’s helping you.

Why Is Shopify With NoFraud Better Than Shopify’s Fraud Tool Alone?

While Shopify’s tool can be useful for identifying obvious fraud (think IP proxy use, multiple card attempts, different billing & shipping addresses), Shopify’s decision making technology is not robust or up-to-date enough to address the increasingly complex methods fraudsters are using today. Moreover, Shopify requires you to manually review each flagged order, while giving you only basic clues as to why the transaction may be illegitimate.

Shopify’s Fraud Tool Analysis Indicators

- Characteristics of this order are similar to fraudulent orders observed in the past

- Card Verification Value (CVV) is correct

- Billing address or credit card’s address wasn’t available

- Billing address ZIP or postal code isn’t available to match with credit card’s registered address

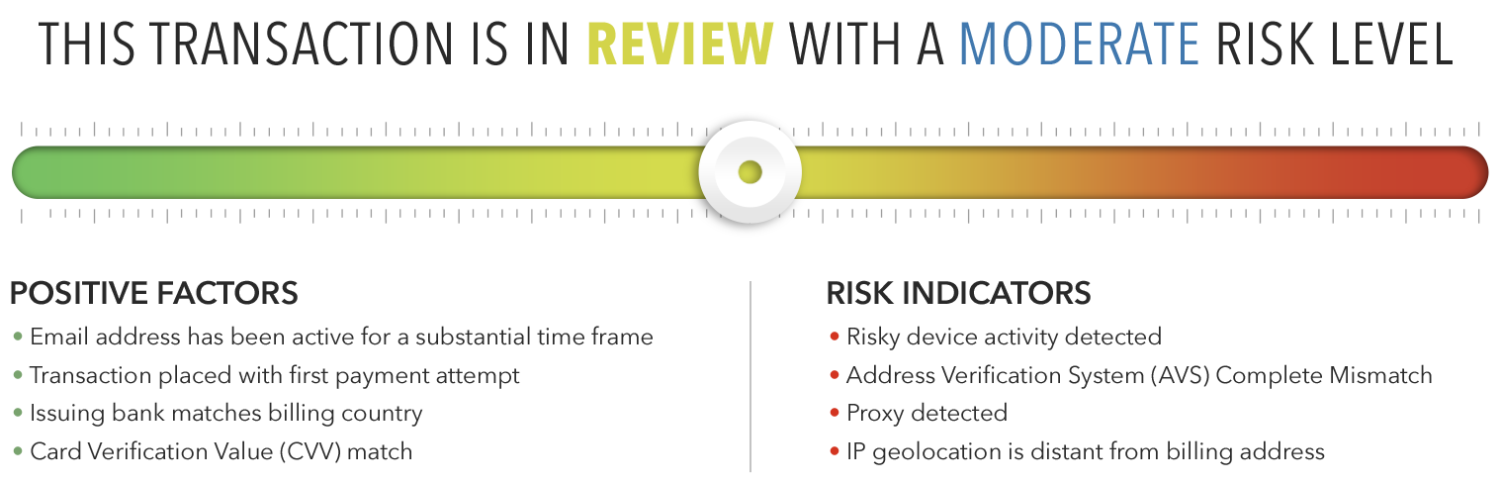

NoFraud Analysis Example

In contrast, NoFraud’s advanced technology enables you to approve more valid orders with cutting-edge fraud detection, saves you time by eliminating onerous manual review, and backs every “pass” decision with our 100% chargeback guarantee. In other words, in the unlikely scenario that NoFraud did not catch a fraudulent charge that Shopify did, we’ll refund the chargeback in its entirety.

Here’s a side-by-side comparison of the two solutions:

| Shopify’s Fraud Tool Alone | Shopify + NoFraud | |

|---|---|---|

| Identifies fraud due to suspicious IP proxy use | ||

| Identifies fraud due to multiple card attempts | ||

| Identifies fraud due to discrepancies in billing & shipping addresses | ||

| Identifies and prevents reseller fraud | ||

| Identifies and prevents promo abuse | ||

| Identifies and prevents friendly fraud | ||

| Identifies and prevents returns abuse | ||

| Employs enriched data from device fingerprinting technology to catch fraud | ||

| Analyzes data from third-party sources to glean deeper insight into one data point (ex. who lives at that address, who owns that cell phone line, etc.) | ||

| Employs human oversight by experienced fraud analysts that will spot a potential false decline and feed the data back for enhanced fraud detection precision | ||

| Eliminates the need for additional manual review of transactions to determine fraud | ||

| Provides simple, actionable decisions of Pass or Fail | ||

| Has a 99.5%+ accuracy rate | ||

| Includes a Chargeback Protection Guarantee: full reimbursement if any chargebacks manage to pass through undetected |