Undisputed chargeback fraud is money left on the table. Unfortunately, too many merchants don’t even attempt to fight chargebacks because the win rate for in-house teams typically ranges from 20-40%. The time and resources required to fight chargebacks in-house can be costly and discouraging, but the good news is that there is hope — and a better way — for merchants. A study by PYMNTS found that 92% of merchants that use a third-party solution for chargeback management are able to keep their losses under 0.5% of total revenue. If your business sees losses above this threshold, keep reading. This guide provides advice on how to fight chargebacks effectively, with some insight into how NoFraud minimizes chargeback losses for our ecommerce merchants.

Mastering Chargeback Management: A Comprehensive Guide for ecommerce Merchants

Introduction

What is Chargeback Management?

Chargeback management refers to the systematic process and strategies implemented by businesses to handle and prevent chargebacks effectively. Chargebacks occur when customers dispute transactions with their issuing banks or credit card companies, leading to the reversal of funds from the merchant. Effective chargeback management involves understanding the reasons behind chargebacks, addressing their root causes, and implementing measures to prevent their occurrence. Here are key components of chargeback management:

- Identification, monitoring, and analysis: Businesses need to identify the reasons for chargebacks by closely monitoring transaction data. Regularly monitoring chargeback data and generating reports can help merchants track trends and identify areas that need improvement. Analyzing the causes helps in understanding whether chargebacks are due to fraud, friendly fraud (customer disputes without valid reason), or merchant errors. This ongoing analysis allows businesses to adapt their strategies and continuously refine their chargeback management processes.

- Prevention strategies: Preventive measures help to minimize chargebacks. Strategies like robust customer communication, clear product descriptions, secure payment processing, and the use of fraud prevention tools focus on addressing common triggers for chargebacks to minimize risk.

- Dispute resolution or representment: When chargebacks occur, a prompt and efficient dispute resolution process is necessary. Merchants should have a system in place to track and respond to chargeback claims, providing evidence to support the legitimacy of the transaction. Timely responses increase the chances of a favorable resolution.

- Policy review: Regularly review return policies to ensure the established procedures align with evolving industry standards and emerging fraud trends that pose a threat to your business. Collaborate across departments during the review process to identify potential loopholes that should be addressed in updated policy revisions. A comprehensive review can help your team create policies that prevent fraudsters from taking advantage of policy gaps and it also helps legitimate customers understand policies, thereby preventing unnecessary chargebacks.

- Customer support and education: Offering excellent customer support helps prevent misunderstandings that can lead to chargebacks. Educating customers about return policies, refund processes, and product details can reduce the likelihood of disputes. Clear communication can also lead to customers resolving issues directly with the merchant instead of involving the bank.

- Data security measures: Implementing robust security measures, including compliance with Payment Card Industry Data Security Standard (PCI DSS), protects customer information and reduces the risk of unauthorized transactions and subsequent chargebacks.

Chargeback management involves a holistic approach to prevent, identify, and address chargebacks, ensuring a more secure and trustworthy payment environment for both merchants and customers.

Understanding Chargebacks

Chargebacks vs. Refunds

Chargebacks and refunds represent distinct routes for resolving customer dissatisfaction. A chargeback occurs when a customer disputes a transaction through their credit card company, introducing a third-party arbiter into the process. It’s akin to involving a mediator to settle a disagreement. Conversely, a refund is a more direct approach, where the customer seeks transaction reversal directly from the business — a straightforward, human-to-human transaction adjustment. While both mechanisms aim to return funds to the customer, chargebacks bring an element of formal procedure, while refunds represent a more interpersonal resolution. While a customer could be so dissatisfied that they initiate a chargeback, it’s more likely that a legitimate customer would go the refund route. Chargebacks are a good indicator that some form of fraud is at play, as 30% of chargebacks are purchases made with stolen credit card information.

Reasons for Chargebacks

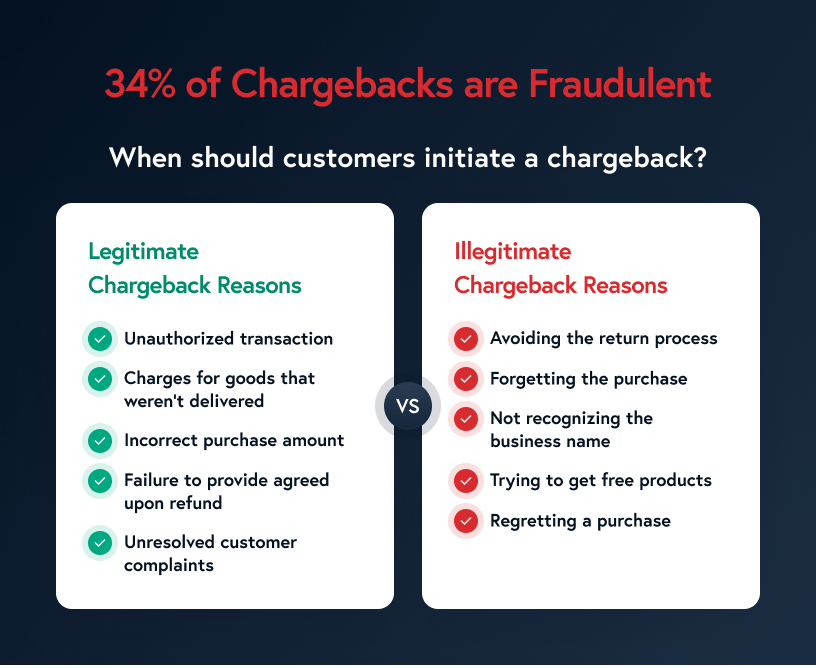

It’s important to understand why customers initiate chargebacks — and what you can do to prevent and dispute them. Generally, chargebacks fall into two groups:

1. Valid Use of the Chargeback Process

The chargeback mechanism provides consumers with a method to contest unauthorized or erroneous transactions on their credit card statements through their bank, bypassing direct interaction with the business. Legitimate credit card disputes include:

- Unauthorized transactions: These fraudulent transactions come from the loss, theft, or unauthorized use of a physical credit card or credit card information.

- Billing errors: Inaccuracies in purchase amounts, failure to credit returns, charges for unaccepted goods, and charges for undelivered goods as agreed.

- Unresolved customer complaints: Disputing charges may occur if a customer is dissatisfied with a business’s response to concerns about quality or other issues or lack of responsiveness.

2. Misuse of the Chargeback Process

Certain situations involve customers filing chargebacks for reasons that lack technical legitimacy, often termed “friendly fraud.” Examples include:

- Avoiding the return process: Customers may opt for chargebacks instead of returns due to perceived difficulties, lack of understanding, or expiration of return time limits.

- Unknown transaction: Forgetting a purchase or not recognizing the business name on the statement, leading to filing a dispute as an honest mistake.

- Claiming fraud on a legitimate purchase: Instances where a customer disputes a charge after legitimately purchasing from a business, attempting to evade payment.

- Regretting a subscription purchase: Initiating chargebacks on subsequent orders because the shopper wanted the discounted price for the initial order.

5 Ways To Prevent Chargebacks

Chargebacks: Impact on Businesses

It’s no surprise that chargebacks can cost businesses enough to hurt their bottom line. Consider this:

- Merchants will be charged a fee by the credit card provider or bank that ranges between $30-$100 per chargeback, regardless of outcome.

- Merchants will spend an average of 1.8 hours resolving each chargeback.

- Payment service providers will penalize merchants that have a growing number of chargebacks with higher fees — and may even decline their right to process credit card transactions.

Chargeback ratios that exceed 1% are most certainly an indicator of fraud. A good chargeback management solution will be able to lower your rates to under 0.5%. Here’s how chargebacks hurt cash flow and profitability for merchants:

- Fees incurred by credit card processors

- Wasted time and resources spent on fighting chargebacks

- Loss of merchandise and revenue from the product(s) the chargeback initiator gets to keep

- Reputation damage from customers who may leave negative reviews impacts how your brand is represented to new customers

- Stress on already busy ecommerce operations teams

How G8Only reduced chargebacks

and doubled revenue with NoFraud

Chargeback Examples

Chargebacks affect all types of businesses. Here are three examples of how chargebacks might play out for businesses and the consequences they face.

ecommerce Fashion Retailer

- Challenge: A popular online fashion retailer experiences a surge in chargebacks due to friendly fraud. Customers are making legitimate purchases but later claim unauthorized transactions, leading to chargebacks.

- Consequence: The retailer faces financial losses, not only from the refunded transactions but also from chargeback fees imposed by payment processors. Additionally, the high chargeback ratio jeopardizes the retailer’s relationship with the payment service provider, risking account suspension.

- Lesson learned: Implementing a robust fraud prevention system like NoFraud Chargeback Management can help identify legitimate transactions, reducing friendly fraud instances and protecting the business from financial setbacks.

Electronics Manufacturer on Marketplaces

- Challenge: An electronics manufacturer selling products on various online marketplaces struggles with a significant number of chargebacks related to false claims of non-receipt of goods (INR Fraud). Some customers are exploiting the system to receive products without paying.

- Consequence: The company faces revenue loss, increased operational costs associated with investigating chargebacks, and damage to its reputation on the marketplace platforms. It also has to deal with the challenge of proving delivery in an online environment.

- Lesson learned: NoFraud can help incorporate advanced fraud detection mechanisms and integrate with marketplaces to prevent false claims, ensuring a more secure and efficient transaction process.

Subscription-Based ecommerce Business

- Challenge: A subscription-based ecommerce business encounters a rise in chargebacks from customers claiming they did not receive the expected value from the service or products, even after using it for an extended period.

- Consequence: The business faces not only financial setbacks from chargebacks but also the risk of losing loyal customers due to dissatisfaction. Managing chargebacks manually is time-consuming and diverts resources from improving the service.

- Lesson learned: A fraud prevention solution like NoFraud focuses on analyzing transaction patterns and customer behavior, which can help identify genuine shoppers and prevent chargebacks arising from dissatisfaction, preserving customer loyalty and reducing financial strain.

A high chargeback ratio is often viewed by payment processors and financial institutions as a sign of potential risks or poor business practices. This can result in increased scrutiny, higher fees, or even the suspension of merchant accounts, causing reputational damage that extends beyond the immediate transaction. Chargebacks can also erode customer trust, as they may be perceived as an indication of a flawed or unsatisfactory transaction process. When customers experience issues and resort to chargebacks instead of direct communication with the merchant, it signals a breakdown in trust. The customer may feel that their concerns are not being addressed promptly or effectively, leading to a negative perception of the business.

Additionally, frequent chargebacks, whether legitimate or not, can lead to the loss of repeat business. Customers may be hesitant to engage with a merchant associated with chargeback disputes, fearing similar issues in the future. This loss of customer loyalty can be particularly damaging because repeat business and customer retention are crucial for sustained success. Merchants may find it challenging to rebuild trust and attract new customers when a reputation for chargeback issues persists.

How to Prevent Chargebacks From Legitimate Customers

Legitimate customers may initiate chargebacks when processes or ways to contact support are unclear. The way to prevent chargebacks from good shoppers is to create a healthy merchant-customer relationship. Here are strategies to help minimize the occurrence of chargebacks while ensuring a positive experience for your legitimate customers:

- Clear and transparent communication: Ensure that your product descriptions, terms of service, and policies are clear and easily accessible. Communicate shipping times, return policies, and any potential fees upfront. This transparency helps customers know what to expect, reducing the likelihood of misunderstandings that could lead to chargebacks. Make sure to include these details in a simplified checkout experience.

- Robust customer support: Provide excellent customer support to address concerns and inquiries promptly. A responsive support team can help resolve issues before they escalate to chargebacks. Make sure customers have multiple channels (email, phone, chat) to reach out, and consider integrating automated chatbots or adding a FAQ page to assist with common queries.

- Accurate product descriptions and imagery: Represent your products accurately on your website. High-quality images and detailed descriptions can set proper expectations for customers. If a product doesn’t meet the description upon arrival, customers may be more inclined to initiate a chargeback. Avoid deceptive practices that might mislead customers.

- Implement fair return policies: Clearly outline your return and refund policies, and ensure they are fair and easily understandable. A customer-friendly return policy can encourage customers to reach out to you first before resorting to chargebacks in the event of dissatisfaction.

How to Protect Your Business From Fraudulent Chargebacks

To prevent fraudsters from attempting chargebacks or to win more chargebacks in representment, implement a third-party solution to help. A full-service fraud prevention, checkout, and chargeback management solution like NoFraud will be able to:

- Use advanced algorithms and machine learning to analyze transactions in real-time, identifying potential fraudulent activity and evolving its ability to detect fraudulent patterns as your business grows.

- Incorporate Address Verification Systems (AVS) and Card Verification Value (CVV) checks during the checkout process. These additional layers of security help ensure that the person making the purchase has legitimate access to the payment method. Fraudsters often lack accurate billing addresses or CVV codes. It’s important to note that AVS mismatches from legitimate shoppers can occur, so you’ll want a solution like NoFraud that can overlook such errors to analyze other fraud prevention data points.

- Manage chargebacks with a team of expert fraud analysts. Instead of taking time away from your support team, who could be working on improving other areas of the business, consider using a team of experts — who fight chargebacks all day — to help you win more disputes. At NoFraud, our team compiles all the important records to create compelling rebuttals and argue chargeback cases to the credit card issuer on your behalf. Our hands-on approach extends to providing feedback on how to avoid future chargebacks.

Additionally, you’ll want to implement a secure and trustworthy payment processing system that uses encryption technologies and maintains updated compliance requirements. A secure payment environment reduces the risk of unauthorized transactions and can build trust with customers. By combining these strategies, merchants can create a secure and customer-friendly shopping environment that minimizes the risk of chargebacks from legitimate customers, while enhancing overall customer satisfaction. For more on chargeback management, check out 5 Ways to Prevent Chargebacks.