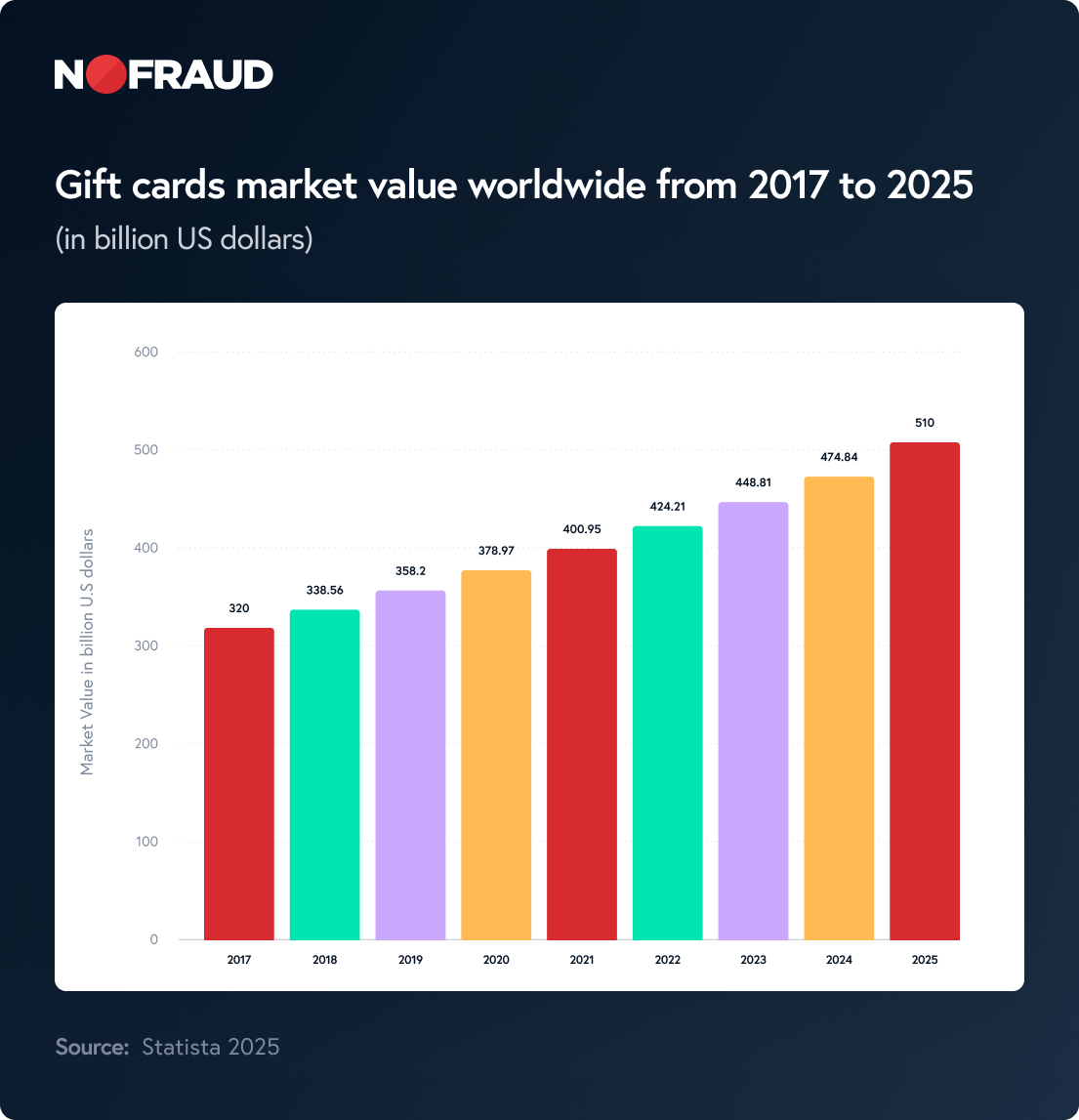

Gift cards are a booming billion-dollar industry — and a favorite target for fraudsters. Whether you’re a consumer purchasing a gift card or a merchant selling them, spotting the warning signs early is essential to avoid financial losses, chargebacks, and falling victim to fraud schemes. With the gift card market projected to hit $510 billion this year, it’s no surprise scammers are on the hunt.

For online shoppers and ecommerce merchants alike, understanding how to identify and prevent gift card scams is critical. Recognizing the red flags early can save you from unnecessary costs, stress, and fraudulent activity. Here are eight warning signs of gift card fraud, along with actionable steps you can take to protect yourself.