At NoFraud, we talk a lot about our Proactive Review approach. But what does that mean exactly? Don’t all fraud prevention companies with chargeback guarantees offer some kind of review? What does it mean to be proactive?

To explain how Proactive Review is different, it’s helpful to understand how fraud prevention companies think about risk.

What are “Grey” Orders?

It’s usually quite evident when a transaction is very trustworthy or untrustworthy. Every fraud software uses algorithms that analyze the data from dozens of sources to determine whether there are enough trust factors or risk factors to automatically pass or decline an order.

The challenge comes with orders which fall in the middle of the risk continuum—transactions that are not obviously trustworthy, yet they aren’t obviously fraudulent either. We call these transactions that display a significant number of both trust and risk indicators “grey” orders because they contain a high degree of uncertainty.

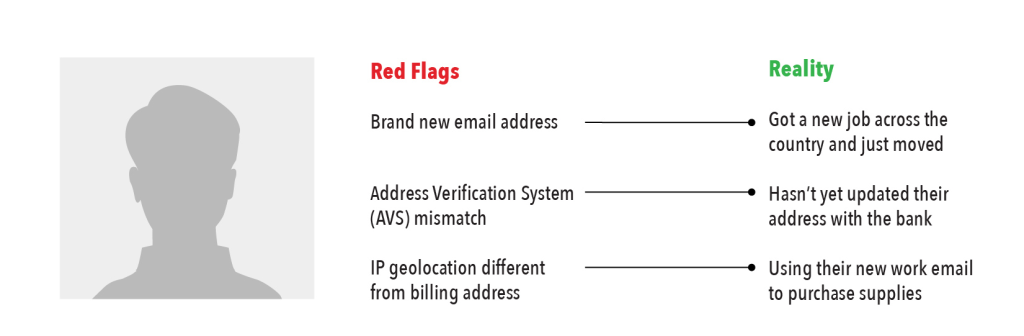

For example, let’s say an order shows some suspicious signs: the address listed with the bank doesn’t match the order, and the email used to place the order is brand new. These could be signs of a fraudster at work, or they could be signs of someone who just started a job in a different city making a purchase using their new company email.

Since this transaction also shows trust factors (CVV match, no risky device detected, etc.), it would likely fall under the category of a “grey” order. So without further review or verification steps, the determination of whether this order gets a pass or a fail is going to be dependent on your fraud prevention provider’s risk tolerance.

How Most Fraud Prevention Providers Deal With Risk

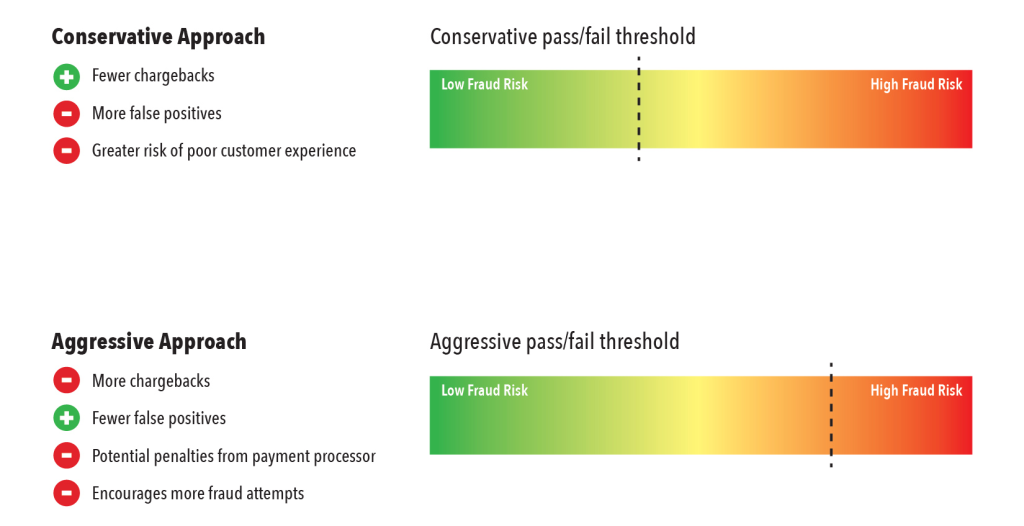

Most full-service fraud prevention solutions rely heavily on automation for decision-making. This means that their algorithm contains a threshold for the amount of risk that they are willing to tolerate. Anything above that threshold will be automatically declined based on the risk score determined by the algorithm.

If the fraud provider uses a more conservative threshold, you get the benefit of rooting out more fraudulent orders. However, the downside is that you’re almost certainly declining good customers as well. On the other hand, an aggressive approach may allow more fraudulent orders through, but you benefit from fewer false positives.

Some fraud prevention companies will even allow you to choose different risk thresholds in the form of a guaranteed order approval rate. For example, if you pay a higher percentage per transaction, they will provide you with a higher approval rate simply by increasing the risk threshold behind the scenes.

However, like with insurance companies, the rate you are charged is carefully calculated to avoid losses on behalf of the fraud company. You might be guaranteed a higher order approval rate, but you’re paying for it in the form of higher fees. Not to mention the additional downsides of encouraging more fraud attempts and negatively impacting your relationship with your payment processor.

The NoFraud Difference: Proactive Review

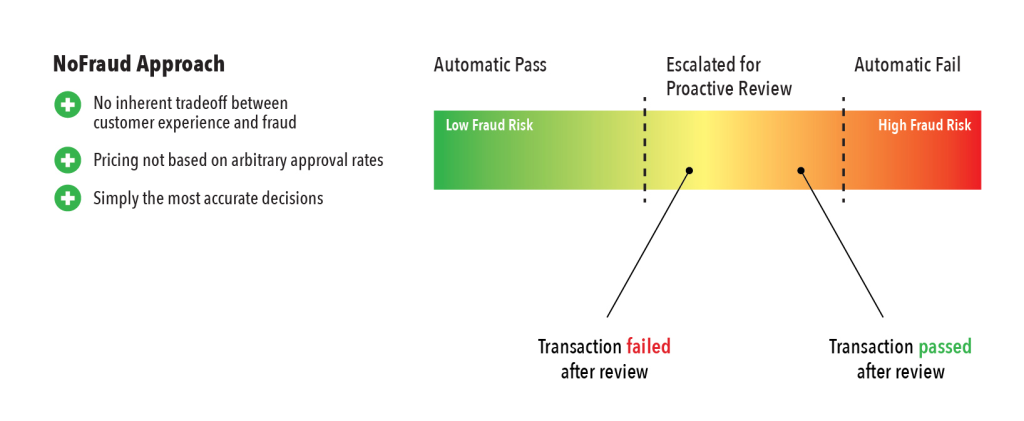

NoFraud’s Proactive Review approach is entirely different. Rather than over-relying on automation, ALL “grey” orders are automatically escalated to our analyst team for review. We also proactively review select high-risk orders, such as orders with a very high order value.

While grey orders make up a small percentage of transactions (usually less than 0.5% for most merchants), how you approach these orders makes a huge difference. Adding an extra layer of review for orders with the highest degree of uncertainty results in more accuracy overall. For instance, a transaction that is flagged by the algorithm to show a high likelihood of fraud is often confirmed as legitimate after further scrutiny by a trained analyst.

In the example of the suspicious order above, a NoFraud analyst would determine through additional research that the purchaser has started a new job at a company whose name matches the email used for the order. In this case, after review, our analysts would pass the order that other fraud software would automatically decline.

Our Proactive Review process enables us to meet our goal of approving the highest number of legitimate orders possible. In fact, most merchants who switch to NoFraud see a reduction in order declines by half, all without increasing the number of chargebacks received.

Proactive vs. Reactive Escalation

So if other fraud companies have a review team of analysts, how is NoFraud different? The difference is in how transactions are escalated for review. While it’s true that most fraud prevention companies do give merchants the ability to flag transactions for review, the onus is on the merchant, rather than the fraud prevention provider, to escalate those orders for further scrutiny. In short, you, the merchant, need to work to get risky orders approved.

In contrast, with Proactive Review, grey orders are escalated automatically, which not only results in a higher-order approval rate but also means that you no longer need to spend valuable time “checking the work” of your fraud analysis software.

While all this happens behind the scenes, the results speak for themselves. Below are just a few reviews NoFraud has received from customers who have switched from other major fraud prevention providers:

“I ran Signifyd and NoFraud at the same time. My approval rate with Signifyd (Revenue) was 90.91%. The approval rate (Revenue) with NoFraud – 97.2%. Switching to NoFraud is a no-brainer.”

Digital Supply USA

Review, Shopify App Store

“NoFraud was recommended to us as a means of increasing our sales. Because NoFraud takes more steps to validate the potential for risk, and the opportunity for passing the customer’s order through, we hoped to be able to increase the number of passed orders, without assuming more risk. We asked NoFraud to prove their claim. They set up a side-by-side comparison with our existing fraud prevention service provider over a two-week period… The overall benefit from NoFraud was evident in the total net value of orders PASSED by NoFraud that were FAILED by our existing provider.”

Smoke Cartel

Review, Shopify App Store

“We switched a year ago from Signifyd to NoFraud and not only did my approval rate increase drastically but pricing was also a lot more competitive.”

DailySale

Review, Shopify App Store

Summary

Bottom line, NoFraud loves advanced analytics as much as the next guy (99.5% of our orders are automatically decided via our algorithm). Still, we also know that maximizing order approval rates requires a combination of both algorithms AND human insight. That’s why we use Proactive Review to make this process as seamless as possible for our customers.