Monoprice Case Study

$1.2M

Additional revenue captured per year

78%

Decrease in order declines due to suspected fraud

72%

Decrease in review orders

$0

Fraud liability

The Company

Monoprice is an e-commerce leader specializing in providing more than 7,500 high-quality yet affordable electronics and tech products. Maintaining a business philosophy that focuses on the needs of its customers, the company strives to bring simplicity, fairness and confidence to consumers and businesses shopping for big-ticket electronics and tech accessories. The company, which sees up to $200M in revenue each year, operates as a tight ship with efficient processes, and passes along that efficiency in the form of lower prices to its customers.

In late 2017, the team at Monoprice saw an opportunity to upgrade its fraud detection efforts, knowing that improvements were likely to streamline operations and increase revenue. The company’s fraud detection process was largely automated, but included a manual review process that required team members to review flagged orders, which often led to order processing delays. Additionally, Monoprice suspected that their process was overly conservative, resulting in the loss of legitimate sales.

The Monoprice team knew that improving fraud detection to decrease chargebacks and validate transactions faster would result in financial gains, as well as an increase in overall productivity. NoFraud offered a turnkey, affordable solution that resulted in major wins for Monoprice.

The Challenges

The team at Monoprice is committed to streamlined operations, so they were particularly bothered by the current fraud protection process, which negatively impacted the customer experience. Monoprice was faced with a number of challenges:

Challenge #1: Potential revenue loss due to overly conservative fraud detection.

“We added new rules to our system every time we encountered fraud. But our detection got so reactionary that the number of orders that were flagged kept increasing. This approach was costing us money.”

Nick Thompson

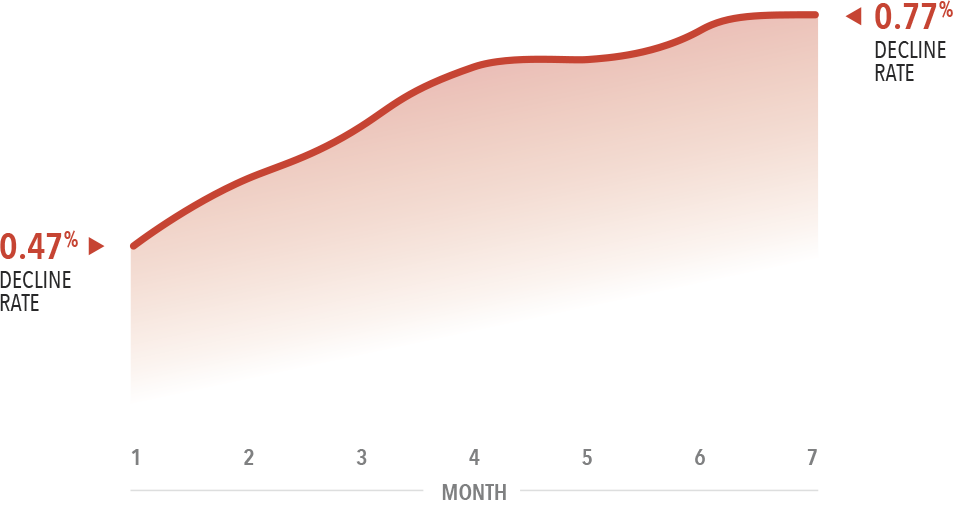

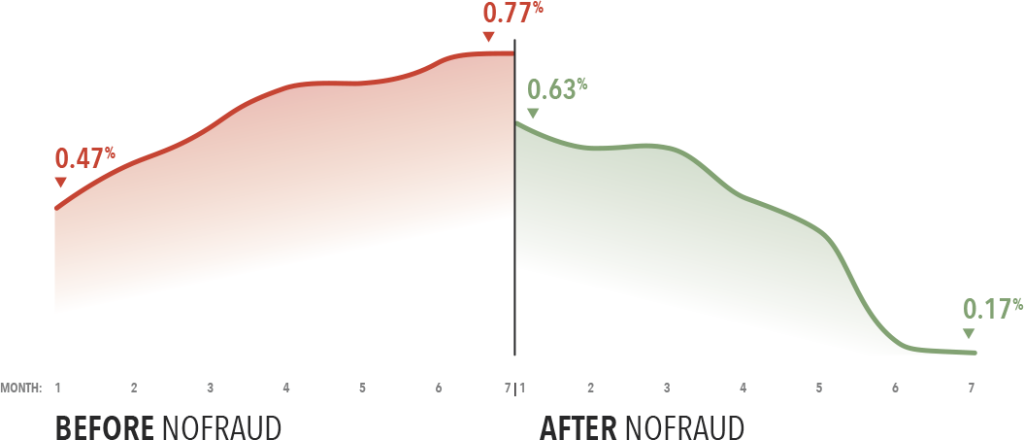

The team at Monoprice believed their current fraud detection process was overly conservative, flagging orders unnecessarily. Each time Monoprice was hit with fraud chargebacks, the team added more restrictive rules, which resulted to an increasingly higher decline rate. From January 2017 through June 2017, their decline rate increased 60%. This lead Monoprice to lose many legitimate orders, decreasing overall revenue for the business.

Challenge #2: The manual review process was slow and could become congested.

“Any time we had a surge of orders, such as during the holiday season or a sale, our review process turned into a bottleneck. Our team couldn’t keep up, and our customers suffered because of it.”

Nick Thompson

The Monoprice team manually reviewed 4% of their orders. As a result, when Monoprice ran a big promotion, there were times when the team was not able to keep up with the demand in order volume and the order review queue took days to clear out. This challenge also appeared during the holiday season, when sales spikes caused review delays, which resulted in a negative customer experience at a time of year when it mattered most.

Customer support was fielding calls from customers asking about the status of their orders, which was a negative experience for customers and a drain on the support team’s time. Aside from the negative customer service experience, this was also costing Monoprice time and resources.

Challenge #3: Despite the team’s hard work, Monoprice was still plagued with chargebacks.

Monoprice prides themselves on operating smartly, so when the team was spending increasingly more hours on manual review, and their chargeback rate was not declining, with losses reaching $40,000 each month, they knew there had to be a better approach to fraud prevention. Their increased efforts were simply not paying off– it was time for a change.

Book NoFraud Demo Today

See Our Accurate Real-Time Fraud Screening for ecommerce in Action

The Solution

The team at Monoprice knew that if they could decrease chargebacks, increase their order approval rate and reduce the number of transactions under review, they could add significant revenue to Monoprice’s bottom line. They began looking for an automated, full service fraud detection solution and settled on NoFraud.

The Monoprice team chose NoFraud because their solution seemed to be the best fit to help them reach their goal of increasing their overall order approval rate, eliminating their chargeback liability, and abolishing their order review process.

NoFraud offered an automated fraud detection process that provided Monoprice with a fraud decision: Pass or Fail. They provided a chargeback guarantee which would reimburse Monoprice if a fraud chargeback occurred on an order they accepted. What was most attractive to Monoprice was NoFraud’s cardholder verification process where NoFraud is able to validate high risk orders with an extremely high level of accuracy and precision.

NoFraud worked with Monoprice as a true partner, coordinating closely with their technology team to implement the solution to Monoprice’s exact specifications.

Thanks to NoFraud, Monoprice was able to overcome their challenges to improve the customer experience and bring in additional revenue.

“We needed to find a partner who could help us improve how we handled fraud detection. NoFraud’s combination of human review and automation seemed like exactly what we were looking for.”

Nick Thompson

The Results

The team at Monoprice knew that if they could decrease chargebacks, increase their order approval rate and reduce the number of transactions under review, they could add significant revenue to Monoprice’s bottom line. They began looking for an automated, full service fraud detection solution and settled on NoFraud.

$1.2M

Additional revenue captured per year

78%

Decrease in order declines due to suspected fraud

72%

Decrease in review orders

$0

Fraud liability

Additional Revenue

“We are capturing a decent amount of additional revenue each month for the company at no risk with NoFraud.”

Nick Thompson

Thanks to NoFraud’s ability to reduce order cancellations due to suspicions of fraud, Monoprice is capturing an average of $100,000 in additional sales per month. Using the previous in-house fraud detection system, Monoprice would have missed out on this revenue.

Zero Fraud Liability

Monoprice used to face $40,000 in monthly chargeback losses, and spent a significant amount of resources disputing those charges. Today, their chargeback liability is eliminated. When they get a fraud chargeback, not only does NoFraud reimburse them for the loss, they also dispute the chargeback on Monoprice’s behalf, saving them the arduous task of chargeback representment.

Smoother Seasonal Spikes

Now that fraud detection is automated, seasonal and holiday spikes do not create any delays. Every year, the Monoprice team used to encounter backlogs and delays during the holidays. This is simply not the case now that they have implemented NoFraud.

International Expansion

Monoprice recently integrated NoFraud into their UK, Germany and France sites, allowing them to scale their business internationally without fear of fraud in an unfamiliar fraud landscape.

Book NoFraud Demo Today

See Our Accurate Real-Time Fraud Screening for ecommerce in Action

Customer Testimonials